Ethanol and Biodiesel in Oregon

<< Back to: Green industry <<

“Oregonians spend $5 billion on gas and diesel — not including aviation fuels — every year,” said Jana Gastellum, global warming program director at Oregon Environmental Council. “We send that money out the door and we don’t reap any benefits.”

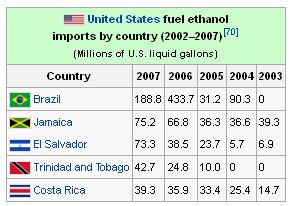

Burning fossil fuel for transportation makes up about 33 percent of Oregon's greenhouse gas emissions, according to the NW Environmental Business Council. The United States is the world's largest producer of ethanol fuel since 2005 Wikipedia. The U.S. produced 10.6 billion U.S. liquid gallons of ethanol fuel in 2009, and together with Brazil, both countries accounted for 89% of the world's production in that year. Ethanol fuel is mainly used in the U.S. as an oxygenate to gasoline in the form of low-level blends, and to a lesser extent, as fuel for E85 flex-fuel vehicles. Most ethanol fuel in the U.S. is produced using corn. Brazil uses sugar cane.

Ethanol yield (gallons/acre) for sugar cane is double that for corn under good tropical conditions. Sugar cane ethanol is said to be seven times more energy efficient, but it doesn't grow well in Oregon.

Oregon has a 5% biodiesel content mandate for all diesel fuel sold in the state. The City of Portland Oregon has a 5% biodiesel content mandate which requires that 50% of the feedstock be from the Pacific NW states. The city and state government believe it will promote the development of a high-tech renewable energy industry based in Oregon.

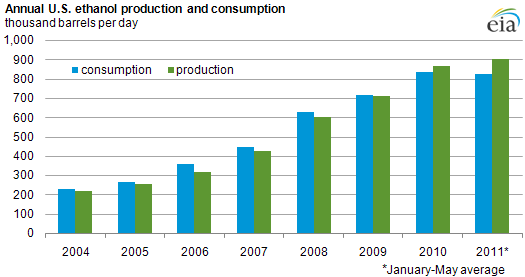

U.S. fuel ethanol production is said to be slowing due partly to sluggish domestic demand for fuel ethanol. Beginning in February 2010, the United States has consistently been a net exporter of fuel ethanol. For the first five months of 2011, U.S. fuel ethanol exports totaled 62,000 bbl/d; exports during the same period in 2010 were only 22,000 bbl/d.

Three companies will co-locate a new distribution facility in Portland's industrial area near NW 28th Avenue to manufacture and distribute biofuels made from sources including recycled cooking oil, reports Sustainable Business Oregon.

- Whole Energy Fuels of Bellingham, Wash., provides BIODIESEL and alternative fuels to customers on the Pacific Coast. They offer biodiesel blends from b5 to b99.

- Oregon Oils collects used cooking oil from about 1,200 Portland-area customers, mostly restaurants.

- Beaver Biodiesel, a biofuels manufacturer, with a production capacity of 1.2 million gallons of biofuel per year, will move its operations from Albany to Portland.

There are several different types of bio diesel:

- Vegetable oil works as an alternative fuel for diesel engines and is distinguished from biodiesel in that it has been discarded directly from a restaurant. Portland's Grease Bus, which takes riders to Mt Hood 6 days a week for $10-$15, fills up using vegetable oil from Portland restaurants. Most diesel engines need modifications to use vegetable oil, typically pre-heating it, otherwise poor atomization, incomplete combustion and carbonization may result.

- Biodiesel refers to a vegetable oil- or animal fat-based diesel fuel. Biodiesel is meant to be used in standard diesel engines and is thus distinct from the vegetable and waste oils used to fuel converted diesel engines. Biodiesel can be used alone, or blended with petrodiesel. Biodiesel that is 100% (unblended) is referred to as B100, while 20% biodiesel is labeled B20. B100 generally cost more than petrodiesel except where local governments provide a tax incentive or subsidy.

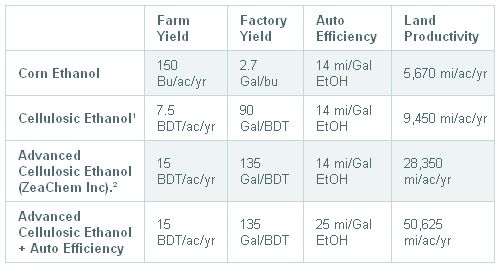

- Corn ethanol, widely tooted as a viable alternative energy approach ten years ago, has been slow to achieve the success its backers hoped. The costs of producing corn ethanol are relatively high, it required too much land and the cost/benefits have not been decisive. Corn is the main ingredient used for producing ethanol fuel in the United States which is mainly used as an oxygenate to gasoline.

- Cellulosic ethanol has one ingredient that Oregon has plenty of -- wood. It is now being examined as a competitive energy resource, but currently it requires extra financial support to develop the infrastructure necessary to the technology. Woodchips and the byproducts of lawn and tree maintenance are some of the more popular cellulosic materials for ethanol production. By contrast, corn ethanol most frequently uses natural gas to provide energy for the process, and may not reduce GHG emissions at all depending on how the starch-based feedstock is produced, says Wikipedia.

The SeQuential Web site (www.sqbiofuels.com) lists biodiesel sites and about 60 Oregon businesses and agencies with biodiesel-powered fleets --wineries, landscapers, contractors, the Eugene public works department, Cross Creek Trucking, Metro, Powells .com, Hoodoo ski resort, and groundskeeping vehicles at Reed College.

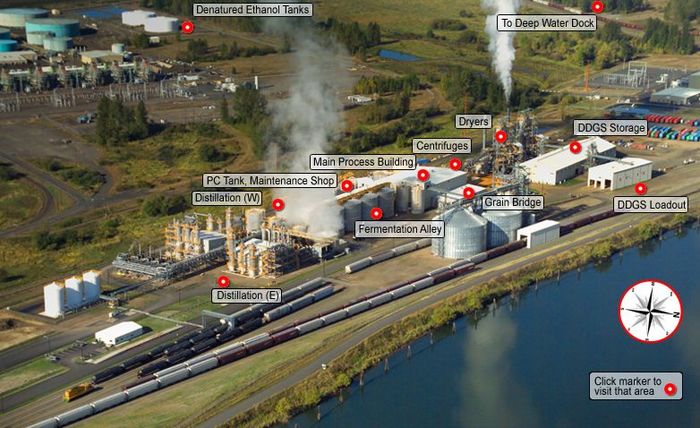

The Cascade Grain Products ethanol plant in Clatskanie (above), filed for Chapter 11 bankruptcy in January, just seven months after it opened. The Clatskanie plant, the state’s largest ethanol production facility, has sat dormant for nearly two years. Now a new owner hopes to attract a buyer for a working ethanol plant.

The 113-million-gallon Cascade Grain plant opened in Clatskanie in 2008 and financed with $100 million in secured bank credit and a $20 million loan from Oregon's State Energy Loan Program. But just seven months later the plant filed for Chapter 11 bankruptcy protection — which later evolved into a Chapter 7 liquidation. Cascade Kelly Holdings, the company — which built the plant for Vancouver, Wash.-based Cascade Grain — is restarting the facility.

In February 2012, the Cascade Pacific Bio-Refinery began (again) producing 120 Million Gallon Per year of ethanol and receiving corn shipments by rail.

The Columbia Pacific Bio-Refinery is the largest ethanol plant on the West Coast of the U.S. with nameplate capacity of 108 million gallons a year. The facility has approximately 8MM gallons of on-site final product storage tanks and potential access to another 18MM gallons of tank storage adjacent to the site. Here's a virtual tour of the facility.

Located at Port Westward on the Columbia River near Clatskanie, Oregon, the restarted Ethanol Plant is located on a short-line railroad, the Portland & Western. The rail line runs through Rainier, Oregon on its way to Astoria and is used primarily to supply logs to the Teevin Bros. yard in Rainier.

Imperium Renewables, in Grays Harbor Washington, opened a 100 million gallon per year capacity in 2007, the nation's largest BQ-9000 certified biodiesel plant. It produces pure, unblended B100 biodiesel refined from a variety of oils; canola grown in the Pacific Northwest and Canada, soy, and many other crops.

In 2011, the National Biodiesel Board estimates that the U.S. biodiesel industry produced a record of nearly 1.1 billion gallons. Still, the corn ethanol market has diminished as production costs have remain relatively high.

In 2010, something like a quarter of all the corn grown in this country went to ethanol production. A new economic analysis from Oregon State University raises questions about the cost-effectiveness and climate impact of biofuels production. The report found that implementing a gas tax to reduce fossil fuel use would have better bang for the buck. "Our results suggest that existing biofuel policies have been very costly, produce negligible reductions in fossil fuel use and increase, rather than decrease, greenhouse gas emissions," said Bill Jaeger, at OSU and lead author on the study.

The community aspect of biodiesel attracts many people, and those folks should contact biodiesel cooperatives such as Portland's GoBiodiesel Cooperative, Green Drop Garage, Flower Power Biodiesel Co-op in Salem or Grease Works! in Corvallis. GoBiodiesel Cooperative makes about 200 gallons a month and is in full fundraising mode to build a new plant that will at least quadruple output. Members pay about $2.25 per gallon, plus a one-time $100 membership fee.

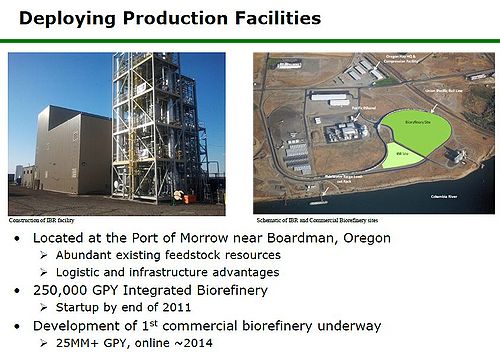

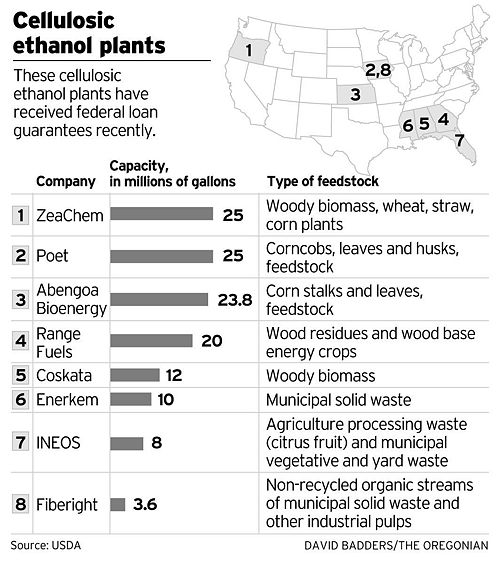

ZeaChem will construct a huge cellulosic biorefinery in Boardman, producing bio-based fuels and chemicals from woody biomass and agricultural residues. The company completed construction of a pilot facility and will ship the fuel down river on barges, through the Port of Morrow.

The new commercial-sized facility is expected to have capacity of 25 million or more gallons-per-year, adjacent to ZeaChem’s 250,000 GPY demonstration biorefinery.

Financed in part with a $235 million loan guarantee from the U.S. Department of Agriculture, ZeaChem, a Colorado-based energy company, expects the $390 million biofuel refinery will be producing fuel and valuable by-products by late 2014. ZeaChem must meet specified conditions before the 60 percent loan guarantee can be completed. Currently, Silicon Valley Bank is the bank of record for the project.

OPB's Ecotrope has Five Things To Know About ZeaChem’s Biorefinery.

To break down biomass, ZeaChem uses a natural bacterium, acetogen, found in termites, cockroaches and other organisms. The bacterium ferments cellulose into acetic acid, which is made into ethanol. No carbon dioxide, a greenhouse gas, is produced in the fermentation.

ZeaChem will make fuel from a 28,000 acre poplar plantation in Boardman owned by GreenWood Resources of Portland. About 70 percent of ZeaChem's raw material will come from those trees. About 30 percent will come from agricultural residue, including feedstock, which costs about 50% less than Brazilian sugar cane and 80% less than corn based processes, says the company.

ZeaChem says advances in ethanol technology and auto efficiency can increase land productivity by a factor of 10.

The EPA waived down the scheduled 500 million gallon mandate for cellulosic ethanol, first proposed back in 2007 when the current Renewable Fuel Standard was developed, down to 10.45 million gallons for 2012. But alternative energy projects are receiving closer scrutiny in Congress due to the bankruptcy filing last fall of Solyndra, the California solar firm that received a $535 million loan guarantee from the U.S. Department of Energy in 2009.

Millions of gallons of capacity are expected to come on line, primarily from POET, Mascoma, Abengoa, Chemtex, BP Biofuels, Fiberight, Solazyme, Amyris and more, over the next 12-24 months.

Biofuels Digest covers the action as does Renewable Energy World.

NEXT: Fuel Cells in Oregon

Back to: Green industry <<